can you pay california state taxes in installments

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. Businesses typically have to repay what is due within.

Can I Pay My Taxes in Installments.

. If one of these events has happened and you are simply unable to pay immediately you may be wondering Can I pay taxes in installments Yes it is possible to pay taxes in instalments. If you are unable to pay your state taxes you can apply for an installment agreement. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been. If approved it costs you 50 to set-up an installment agreement added to your balanceIf you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an. What do you do if you owe state taxes and can t pay.

You owe 50000 or less in combined tax penalties and interest and filed all. An application fee of 34 will be added. Typically you will have up to 12 months to pay off your balance.

Yes you can use the APs income tax payment plan to pay what you owe over time in government taxes. Can Taxes Be Paid in Installments. Can You Pay California State Taxes in Installments.

Long-term payment plan installment agreement. Paying in installments allows you to manage your. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

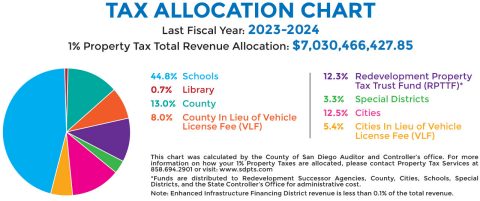

Box 2952 Sacramento CA 95812-2952. New Program Allows Taxpayers Pay Annual Property Taxes in Monthly Installments. If a Full Payment Agreement is not financially attainable you may be eligible for a Long-Term Payment Plan which entails an Installment.

I have installments set up for my federal taxes but I did not see an option for California state taxes. If you cannot pay the full amount of taxes you owe you should still file your return by the deadline and pay as. If one of these events has happened and you are simply unable to pay.

County Taxpayers can use Easy Smart Pay to make monthly payments for annual property taxes. It may take up to 60 days to process your request. If you owe taxes to the State of California but you cant pay the entire amount by the deadline you might be able to set up a payment plan.

Usually you can have from three to five years to pay off your taxes with a state installment agreement. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. If you are an individual you may qualify to apply online if.

UNIKO Media Group. More In News Dont panic. As an individual youll have to pay a 34 setup fee which will be added to your balance when you set up a payment plan.

California Franchise Tax Board Ftb Help Landmark Tax Group

California State Tax H R Block

How Does Property Tax Work In California Quora

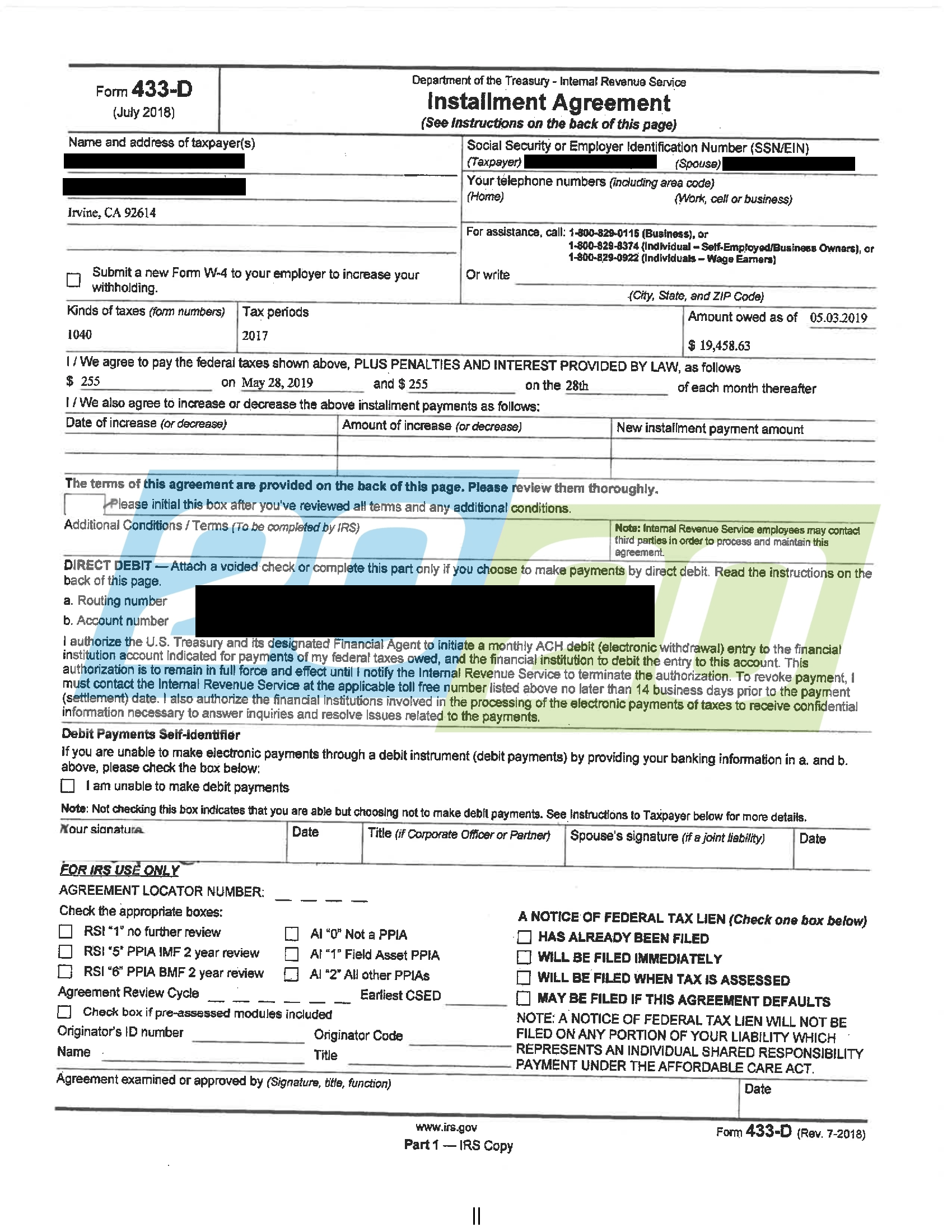

Irs Accepts Installment Ageement In Irvine Ca 20 20 Tax Resolution

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Can The Irs Take Or Hold My Refund Yes H R Block

California Franchise Tax Board Information Larson Tax Relief

California Tax Debt Forgiveness Will The Ca Ftb Really Forgive Tax Debt Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

California Provides Path To Deduct State Income Tax For Calculating Federal Tax Updated

Irs Form 540 California Resident Income Tax Return

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

California Tax Forms H R Block

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Is It Possible To Pay Income Tax In Installments Quora

What You Should Know About Property Taxes In California Nicki Karen

Payroll Tax Calculator For Employers Gusto

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

:max_bytes(150000):strip_icc():gifv()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)